In our previous article on capitalizing on your IFRS 17 investment, we explored the myriad of challenges faced by insurers, including the lack of a unified perspective on how the IFRS 17 financial close process would operate in a Business as Usual (BAU) state. Many teams are still producing IFRS 17 results in a project setting, which lacks the stability they would experience in a BAU (business-as-usual) setting. To address this issue, organizations should comprehensively reassess their Finance organization’s Target Operating Model (TOM) to facilitate effective knowledge transfer from project resources to operational teams.

When applied specifically to the realm of IFRS 17, a TOM provides a high-level view of the end-to-end solution design, processes, controls, and close schedule required to execute the new finance model. Given the added complexity of IFRS 17, the cross-functional hand-offs between the various finance, actuarial, and technology teams will also have to be layered into the updated TOM.

Our updated TOM not only assures a smooth transition to a BAU state but enhances the long-term operational resilience of the finance organization.

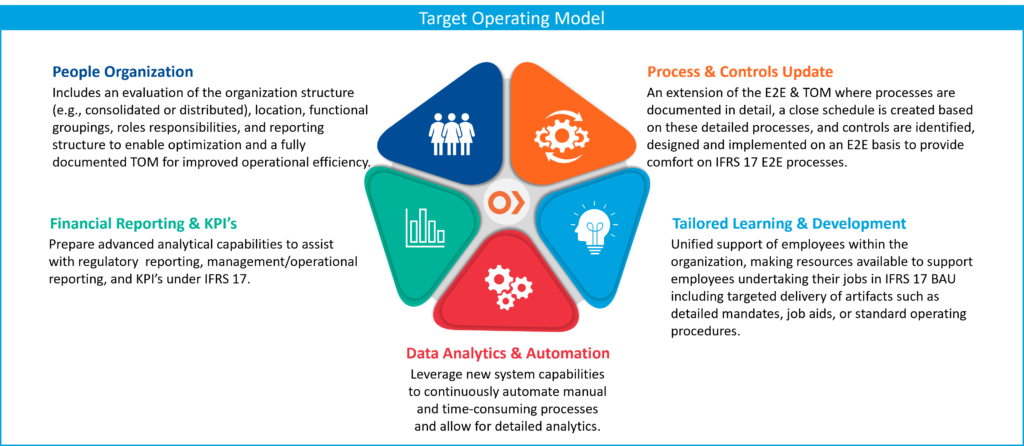

Essential Components of the TOM Include:

Process & Controls Revamp: This serves as an extension of the End-to-End architecture, documenting processes in detail, updating close schedules, and identifying and mitigating risks through the implementation of revised controls.

Customized Learning and Development: Speed up Change Management by instituting a bespoke Learning and Development program that underlines policy changes and alterations in solution architecture. This incorporates the delivery of key artifacts like detailed mandates, job aids, and standard operating procedures.

Data Analytics and Automation: Utilize new system capabilities to consistently automate labour-intensive processes, freeing resources to perform in-depth analytics.

Financial Reporting and KPIs: Develop advanced analytical capabilities to assist with regulatory reporting and upgrade the budgeting/management reporting cycle to leverage new KPIs available under IFRS 17.

Organizational Structure: Adopt a suitable delivery model (Centralized, Decentralized, Shared Services etc.) to ensure optimal resource deployment across the organization, particularly within finance operations (FINOPS), planning and analytics, and specialty departments.

Benefits of Updating the TOM

- Enhanced Financial Reporting: A TOM can help streamline the finance processes and systems, enabling the department to efficiently capture and process the required data for IFRS 17 reporting. By establishing standardized procedures, data structures, and controls, the TOM ensures accurate and timely financial reporting in compliance with the new standard.

- Improved Data Management: IFRS 17 demands extensive data management capabilities due to its complex requirements. A TOM can provide the necessary framework for data governance, data quality controls, and data integration, enabling the finance department to effectively handle the large volumes of data required for IFRS 17 calculations and disclosures. This can reduce errors, improve data accuracy, and enhance data transparency.

- Efficient Process Integration: IFRS 17 implementation often involves coordination between multiple departments and stakeholders. A TOM facilitates the integration of processes, systems, and people across the organization. It establishes clear roles, responsibilities, and workflows, ensuring efficient collaboration and reducing duplication of efforts. This integration can help the finance department align with other departments (such as actuarial, risk management, and IT) to meet IFRS 17 requirements effectively.

- Enhanced Control Environment: IFRS 17 introduces new measurement models and disclosure requirements, which may require additional controls to ensure accuracy and compliance. A TOM enables the finance department to design and implement robust control frameworks tailored to IFRS 17, including control self-assessments, reconciliations, and data validation processes. By strengthening the control environment, the TOM mitigates risks associated with IFRS 17 implementation, such as errors, misstatements, and non-compliance.

- Increased Cost Efficiency: IFRS 17 implementations have been resource-intensive due to its complexities. A TOM helps optimize the allocation of resources within the finance department. By streamlining processes, eliminating redundancies, and leveraging technology, TOM enhances operational efficiency and reduces costs.

Considerations must be given to tailor the TOM to the unique circumstances of each organization. The level of change that the organization can accept in the new BAU state after completing the IFRS 17 program and the integration of the program and BAU teams are crucial factors, especially after the grueling implementation that many organizations have gone through.

A Final Thought

A robust Target Operating Model provides everyone with stability, clarity and comfort in their work which is crucial to job satisfaction and success. When there’s stability, it’s easier for new ideas to grow and take shape. It’s these fresh ideas that can continue to fuel the transformation that many Finance Organizations seek.

At Optimus, we can help your organization elevate its TOM to ensure that the finance organization is appropriately structured around the updated process and systems that have been implemented. In doing so, teams can focus on extracting value out of the investments already made in IFRS 17. To learn about how our services can help, please reach out.

Optimus SBR’s IFRS 17 BAU Acceleration Services

Our IFRS 17 BAU Acceleration services help organizations fully leverage their IFRS 17 infrastructure to optimize their investment. Our team is one of the most experienced in the industry, having already supported 24 organizations, both in Canada and globally, through their implementation journey. We have the proven strategic and tactical expertise to help insurers get the most out of this new standard.

Contact Us for more information on how we can assist your team.

Evan Farlinger, CPA, CA – Principal, Financial Services Practice

Evan.Farlinger@optimussbr.com

Farshid Buhariwalla, CPA, CA – Principal, Financial Services Practice

Farshid.Buhariwalla@optimussbr.com

Industry Insights

Service Insights

Case Studies

Company News