The way customers bank is constantly evolving, but 2020 has seen one of the most dramatic shifts in customer behaviour that global Financial Institutions have ever experienced.

The impacts of COVID-19 have caused Financial Institutions to witness the rapid acceleration and adoption of their digital channels. While this shift is welcomed by the industry, it has nonetheless occurred faster than anticipated. These behavioural changes represent a unique opportunity for Financial Institutions globally to re-evaluate and re-position their product offerings in a manner that drives desired behaviours from their customers. Understanding customer behaviour is mission critical to effective product management. The goal of effective product management is to ensure that products remain relevant, competitive, and profitable in the current environment. This is where Product Optimization comes into play.

What is Product Optimization?

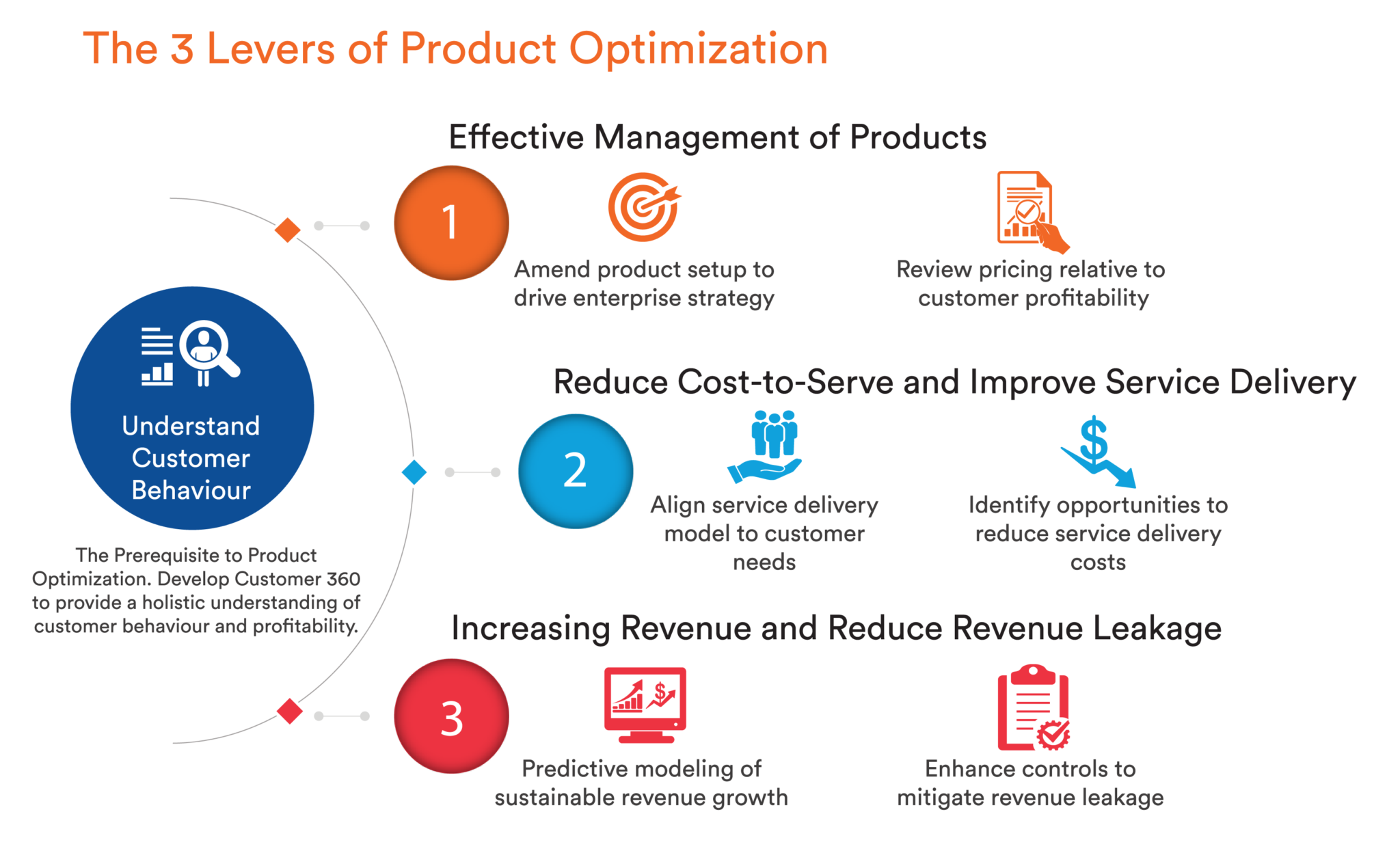

Product Optimization uses customer behaviour insights to assess product alignment to strategy and identify opportunities that will drive rapid bottom line impact. It also enhances service delivery and operational controls and is driven by three main levers:

- Effective Management of Products

- Reduction of Cost-to-Serve through the Improvement of Service Delivery

- Revenue Growth / Reduction of Revenue Leakage.

How Can Product Optimization Help?

The role of the Product Manager has never been more important and more difficult. With changing patterns of customer behaviour, existing product offerings may no longer be reflective of current customer needs. Product Optimization is designed to support Product Managers in their efforts to understand customer behaviour and tailor products to meet the current and future needs of your customers.

Product Optimization helps ensure that your product offering meets the needs of your customers in a cost-effective manner while remaining aligned to your Bank’s strategic objectives. Whether it be setting-up products to drive and sustain digital adoption, increasing revenue, reducing customer attrition, increasing your share of wallet, or a combination of these, Product Optimization can assist in achieving your goals. Any changes to your current product offering will not only have a lasting impact on how customers view your ability to meet their needs, but also must be considered in the broader context of the customer’s profitability, inclusive of cost-to-serve, to ensure sustainability.

A few key learnings to consider

If you are looking to optimize your products, consider the following key learnings:

- Everything is driven from the customer.

We cannot stress this one enough – without being able to understand customer behaviour changes and the reasons for their engagement (or lack thereof) with your products, you cannot ensure that you’re actively promoting and selling the “right” products. Understanding who your customers are, their transactional patterns, what your relative performance is in your segment, and what additional key metrics should be tracked on a go-forward basis is essential to managing your products.

The data collected through the Product Optimization review can also support the development of additional MIS and reporting including Customer Profitability analyses, over-the-counter migration tracking, and Retail branch network reporting.

- Make bold changes.

It’s not enough to make tweaks to existing products and follow in the steps of competitors. If you’re not focused on the optimization of products, you could be missing out on a competitive advantage or leaving dollars on the table.

With the increasing rate of change in financial services, institutions are facing challenges from the market as well as competition from both traditional competitors and emerging fintech companies who have the flexibility and agility to make larger scale changes in a rapid manner.

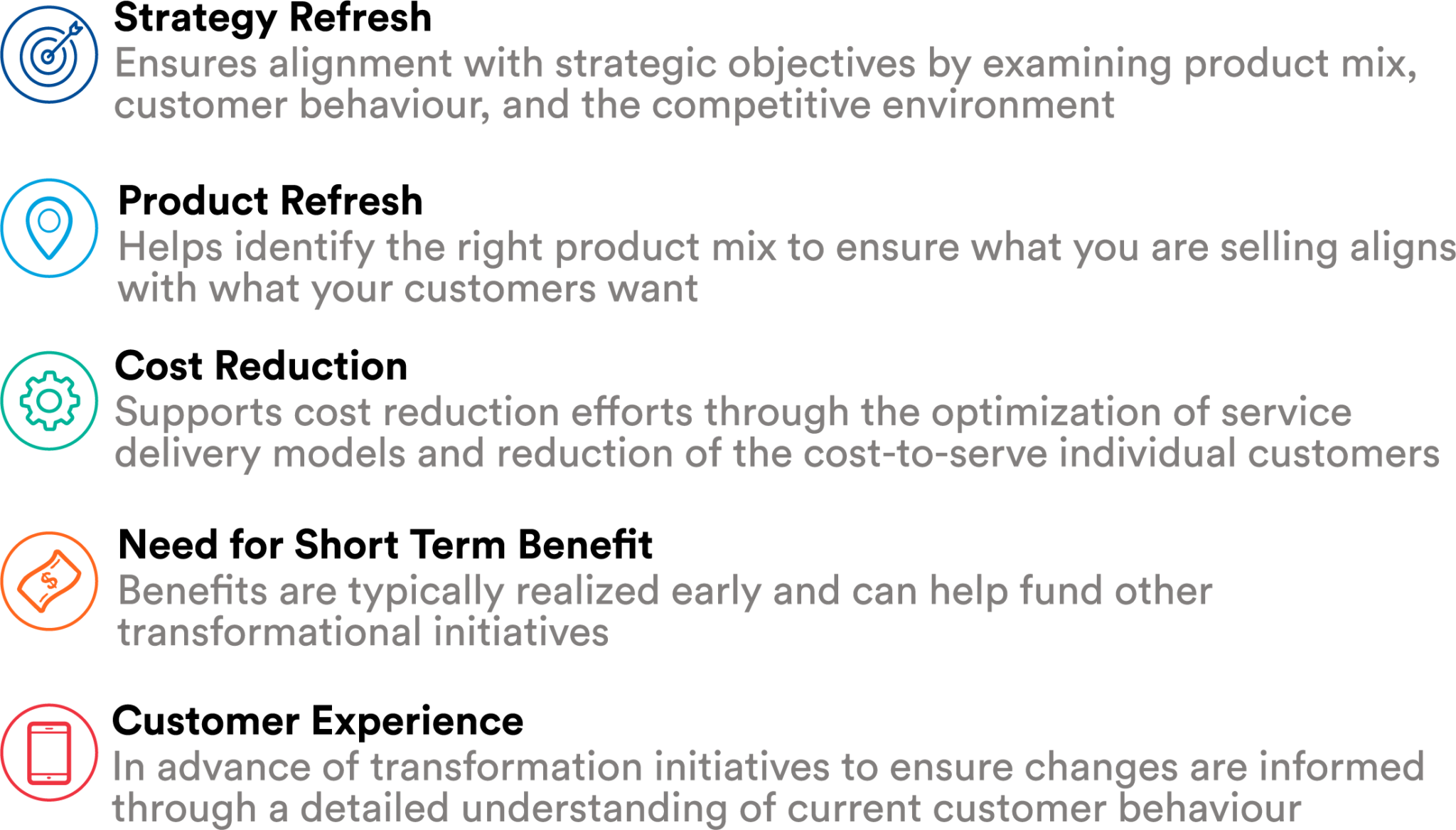

3. There’s no “wrong” time to engage in Product Optimization.

Optimization efforts can be focused in any of the following aspects or combinations thereof:

A Final Thought

Effective product management is no longer a nice to have, it’s key to driving the success of your business in this changing environment. Whether you’ve already started your Product Optimization journey or don’t know where to begin, we can support your team with everything from strategy through to sustainment of changes and help ensure that your products and their delivery reflect customer needs.

Our Product Optimization service offering is designed to supplement the capacity of resource constrained product management teams. We work alongside and directly with your Product Teams in order to enhance capabilities and ensure sustainment well after our team is gone. Our experience with these engagements is that they quickly pay for themselves and provide sustainable long-term benefits with a lasting impact on the bottom-line of our clients.

Optimus SBR’s Financial Services Practice

Optimus SBR is an independently owned management consulting firm that works with organizations across North America to get done what isn’t. Our Financial Services Group provides strategic advisory services, process improvement services, risk management services, and project management support to leading Financial Institutions, insurers, asset managers, and pension funds in North America. We have more than 35 years of industry experience in Retail Banking, Wholesale Banking, Institutional Banking, Small Business Banking, Corporate Services and Insurance.

If you’re interested in learning more, give us a call, or send us a note.

Carolyn Kingaby, Practice Leader, Financial Services

Carolyn.Kingaby@optimussbr.com

416.649.9219

Peter Snelling, Senior Vice President, Business Development

Peter.Snelling@optimussbr.com

416.649.9128

Adam Parsons, Vice President, Financial Services

Adam.Parsons@optimussbr.com

416.649.6047

Industry Insights

Service Insights

Case Studies

Company News