Let’s start with a big congratulations! You’ve made it, or are very close, and are now in a world of IFRS 17 compliance. Take your pat on the back, take a bow, and thank your project teams and all the functional areas that made this long-drawn-out miracle possible.

Now take a deep breath. Try and fight off that nagging feeling…

Why does it feel like this was just the tip of the iceberg?

For many, moving to IFRS 17 compliance has not meant moving into Business-as-Usual (BAU). In discussions with many insurers across the industry and throughout Canada and the Caribbean, there has been a struggle to deploy IFRS 17 beyond the direct project teams and move into BAU. The project started with design & discovery, writing policy papers, and outlining requirements. It moved through implementation and several iterations of testing and tuning the key items to get to compliance. Comparative re-runs and/or movement to parallel felt like pulling teeth to make it work, with some insurers in different jurisdictions still working through this component.

The Struggle to Achieve BAU

So why do numerous companies working towards compliance in their first reporting period or having just completed Q1 struggle to achieve BAU? This is primarily due to a few factors:

- Separate Programs: Most organizations had separate IFRS 17 programs, distinct from their day-to-day finance organization. Due to competing priorities to achieve IFRS 17 compliance, BAU teams were not integrated during testing or comparative/parallel phases and appropriate handovers were not planned.

- Unclear Roles and Responsibilities: There was no unified understanding of how IFRS 17 Financial Close would operate in BAU. Roles and responsibilities in BAU were unclear because project resources had always managed them.

- Unfamiliar Process Flows: While teams are familiar with IFRS 4 processes, they lack comprehension of the detailed process flows under IFRS 17, which are significantly different and not a simple modification of current BAU practices.

- Untapped Potential: Although organizations can produce IFRS 17 Financials, they lack an understanding of the outputs’ meaning, how to forecast under IFRS 17, and how to leverage investments in the various infrastructures introduced.

Without proper guidance and support, most insurers will not be able to fully capitalize on their IFRS 17 infrastructure investments. This includes those common elements that come with every IFRS 17 implementation such as a Data Lake, an IFRS 17 Measurement Tool, General Ledger updates, or in some cases, a new Subledger and the various reporting tools required to link multiple datasets and ultimately move to a fully transformed BAU.

Where is Your Organization on the Spectrum from MVP to Full Transformation?

The good news is that you can get there! Optimus SBR helps organizations navigate the path to accelerate to BAU with IFRS 17. Our support and implementation services include:

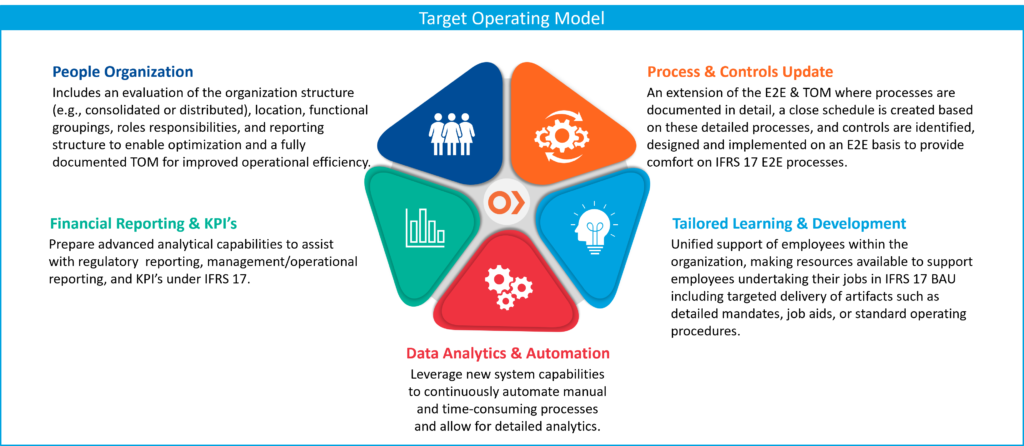

- Target Operating Model Development

- People Organization

- Process & Controls Mapping

- Financial Reporting & KPI Development

- Tailored Learning & Development

- Data Analytics & Automation

We Can Help Accelerate Your Transformation to BAU With Our Implementation Services

A Final Thought

Despite the investment required to reach compliance, insurers have yet to reap the full benefits of IFRS 17. We can help transform your program to BAU going forward. To learn more about how our services can help drive value from your IFRS 17 implementation investments, please reach out.

Optimus SBR’s IFRS 17 BAU Acceleration Services

Our IFRS 17 BAU Acceleration services help organizations fully leverage their IFRS 17 infrastructure to optimize their investment. Our team is one of the most experienced in the industry, having already supported 24 organizations, both in Canada and globally, through their implementation journey. We have the proven strategic and tactical expertise to help insurers get the most out of this new standard.

Contact Us for more information on how we can assist your team.

Evan Farlinger, CPA, CA – Principal, Financial Services Practice

Evan.Farlinger@optimussbr.com

Farshid Buhariwalla, CPA, CA – Principal, Financial Services Practice

Farshid.Buhar

Industry Insights

Service Insights

Case Studies

Company News